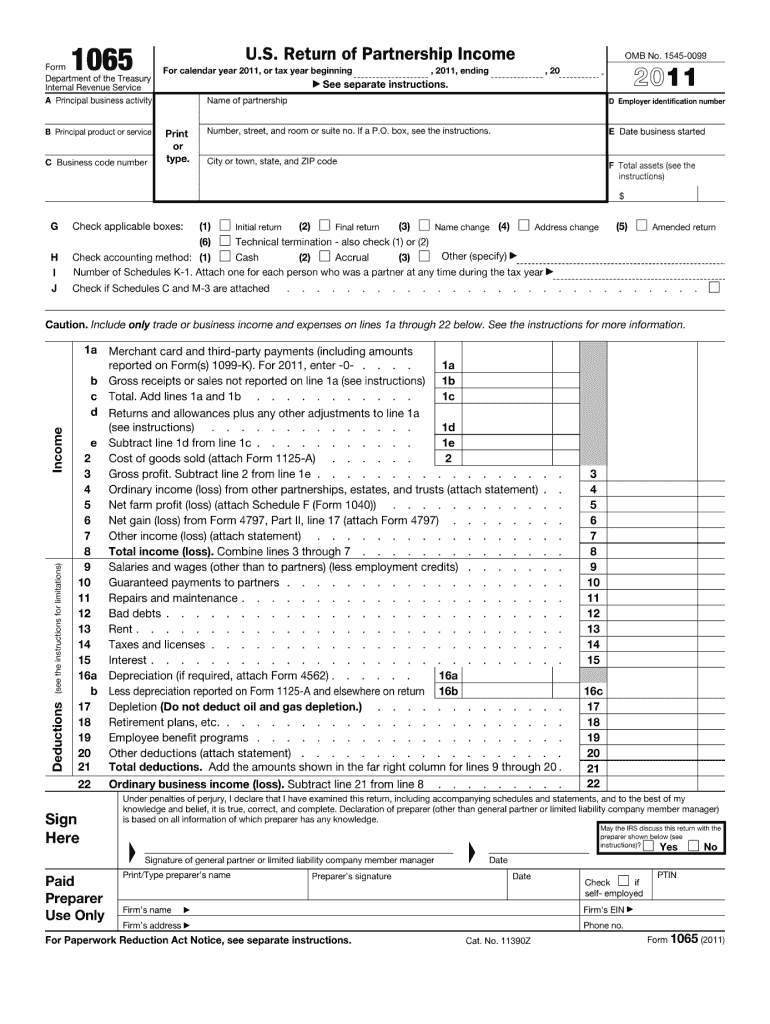

Most states do not conform to the procedural rules in the Internal Revenue Code (the Code), and they currently have no formal state procedures to follow when a partnership is selected for a BBA audit or makes adjustments at the federal level. For tax years beginning in 2018, any partnership that is required to file Form 1065 is subject to the BBA rules (BBA partnership), unless it makes a valid election to opt out. However, a partnership may elect to push out the adjustments to the partners, thus requiring the partners to pay the tax owed. Return of Partnership Income, to effectuate any changes to an originally filed Form 1065.Īs a refresher, the BBA implemented a default rule requiring the partnership, as opposed to the individual partners, to pay any tax owed that is attributable to an adjustment on the partnership return. Most pertinent here, the BBA also updated the process for amending federal partnership returns, requiring more than an amended Form 1065, U.S. To date, only a handful of states have passed legislation in response to the BBA, which repealed the partnership audit provisions of the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) and implemented a new federal regime for auditing partnerships.

114- 74, fundamentally changed the way partnerships are audited and partnership returns are amended for federal tax purposes, but the effect on state returns is still relatively uncertain. The Bipartisan Budget Act of 2015 (BBA), P.L.

0 kommentar(er)

0 kommentar(er)